In the rapidly evolving landscape of business-to-business (B2B) payments, accounting and bookkeeping firms stand on the cusp of a significant transformation. The integration of Accounts Payable (AP) management services into their traditional offerings is not just an enhancement of their service portfolio but a strategic move to capture a burgeoning market opportunity. The B2B payments sector, valued at a staggering $17 trillion, represents a potential $500 billion annual service revenue opportunity, underscoring the vast potential for firms ready to innovate and diversify their services.

The Untapped Potential in AP Services

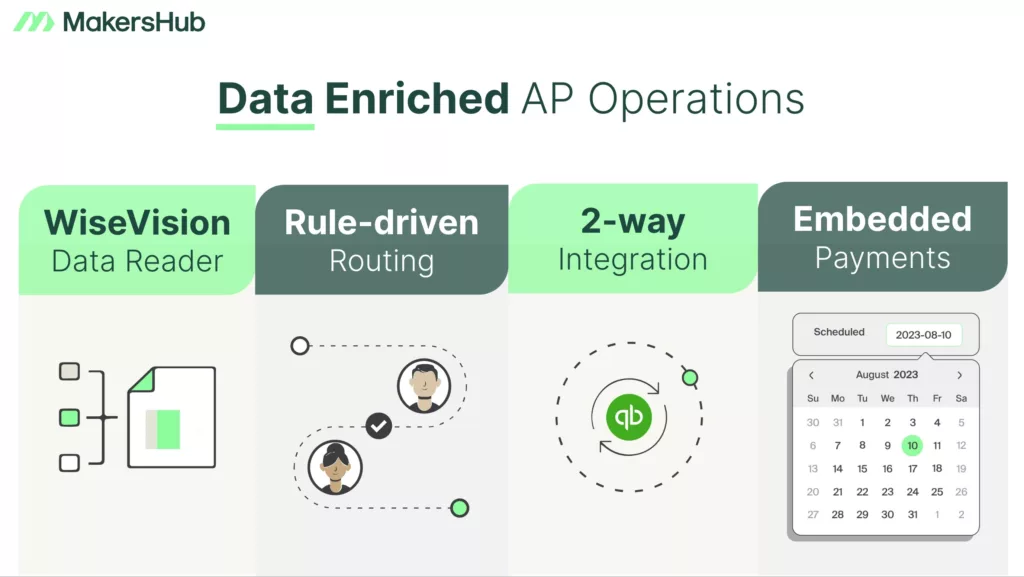

Accounts Payable (AP) management emerges as a critical segment within the B2B payments landscape, with an incremental service revenue opportunity estimated between $40 billion to $45 billion. This opportunity is rooted in the shift from labor-intensive, paper-based AP processes to fully digitized systems. The transition to digital AP solutions not only promises up to 70% cost savings for businesses but also offers a suite of operational efficiencies and strategic benefits. These include enhanced visibility into cash flows, improved working capital performance, and the automation of billing processes, leading to significantly lower operating costs and a reduction in exceptions and returns, which are major bottlenecks in the AP cycle.

Why Firms Should Think About Adding AP Services

Increased Client Retention and Revenue Streams

Integrating accounts payable (AP) management services into an accounting firm’s offerings can significantly impact client retention and open new revenue streams. This integration directly caters to the pressing needs of businesses, significantly reducing the time and financial resources spent on manual invoice processing. By addressing these inefficiencies, firms not only enhance client satisfaction but also foster a deeper loyalty by demonstrating their commitment to solving practical business challenges. The transition to automated AP solutions promises considerable operational efficiencies and cost savings, presenting a strong value proposition to clients. It encourages businesses to look towards a single provider for a more comprehensive suite of financial services, thereby increasing their dependence and trust in their accounting firm.

Offering AP management services aligns with the growing trend towards digital transformation in financial operations. As businesses increasingly seek out solutions that can streamline their processes and offer real-time financial insights, accounting firms that provide such innovative services position themselves as indispensable partners in their clients’ growth and success. This not only aids in retaining current clients by meeting their evolving needs but also attracts new clients looking for modern, efficient financial management solutions.

The strategic addition of AP management services thus serves as a catalyst for growth, enabling firms to differentiate themselves in a competitive market. By leveraging technology to offer tailored, efficient AP solutions, firms can unlock new revenue opportunities while providing measurable benefits to their clients. This dual advantage strengthens the client-firm relationship, ensuring that firms not only retain their current client base but also expand it by appealing to forward-thinking businesses seeking to optimize their financial operations.

Competitive Differentiation

In today’s fiercely competitive market, accounting and bookkeeping firms must distinguish themselves to attract and retain clients. Offering a comprehensive suite of services that includes accounts payable (AP) management is a key strategy for achieving competitive differentiation. This approach not only showcases a firm’s ability to address a broad spectrum of financial challenges but also positions it as a solutions-oriented partner. By integrating AP management into their service offerings, firms demonstrate a deep understanding of the intricate challenges businesses face with invoice processing and financial management. This proactive approach in offering tailored solutions helps firms stand out, signaling their commitment to delivering value beyond traditional accounting and bookkeeping services.

Competitive differentiation through AP management services speaks directly to the needs of modern businesses, which are increasingly looking for ways to optimize their operations and reduce overhead costs. By adopting and promoting the use of advanced AP solutions, firms can offer their clients significant benefits, including reduced processing costs, improved operational efficiency, and enhanced financial transparency. These benefits not only strengthen the client-firm relationship but also position the firm as an industry leader in innovation and client service. Firms that leverage AP management as a differentiator are better equipped to meet the evolving expectations of their clients, offering them a strategic advantage in an ever-changing business environment.

The strategic inclusion of AP management services enables firms to tap into new market segments and attract a wider range of clients. Businesses of all sizes, from small startups to large corporations, face challenges with manual invoice processing and are in search of efficient, cost-effective solutions. By catering to this demand, accounting firms can expand their client base, increasing both market presence and revenue streams. This diversification of services not only enhances the firm’s competitive edge but also ensures its resilience against market fluctuations, securing its position as a comprehensive financial services provider in the long term.

Operational Benefits for Clients

The transition from manual to automated accounts payable (AP) processes marks a pivotal shift in how businesses manage their financial operations, offering a myriad of operational benefits that can significantly impact their bottom line. This shift not only facilitates substantial cost reductions but also streamlines workflow, thereby enhancing overall operational efficiency. By leveraging advanced technology and specialized expertise, firms can help their clients overhaul their AP processes, reducing the time and resources traditionally required for invoice processing. This modern approach to AP management minimizes the risk of human error, ensures timely payments, and thus helps avoid late payment fees. The efficiency gained through automation allows businesses to take advantage of early payment discounts, further optimizing their cash flow and saving costs.

Automated AP processes offer strategic advantages in terms of risk mitigation and compliance. By implementing robust AP solutions, firms can provide their clients with better controls over their payables, enhanced audit trails, and improved compliance with regulatory requirements. This level of financial oversight and control significantly reduces the risk of fraud and ensures accuracy in financial reporting, which is critical for maintaining the integrity of a business’s financial standing. The data insights gained from automated AP systems allow for better financial planning and decision-making. Companies can analyze their spending patterns, negotiate better terms with suppliers, and make informed choices about their financial strategies, leading to more resilient and adaptive business operations.

The adoption of automated AP processes can dramatically improve the relationship between businesses and their suppliers. By ensuring timely and accurate payments, companies can build stronger, more reliable supply chains. This reliability can lead to improved negotiations, better terms, and a more collaborative approach to addressing supply chain challenges. Additionally, the shift towards digital processes reduces the environmental impact associated with paper-based systems, aligning with the growing emphasis on sustainability in business practices. The operational benefits of moving from manual to automated AP processes extend beyond mere cost and efficiency gains, offering businesses a comprehensive suite of advantages that enhance their competitive edge, support their growth, and contribute to their long-term sustainability.

A Call to Action for Accounting Firms

For accounting and bookkeeping firms, the AP management space is ripe with opportunities for those willing to embrace technological advancements and expand their service offerings. By integrating AP management solutions, firms can deliver exceptional value to their clients, helping them navigate the complexities of modern financial operations while securing significant cost savings. This not only strengthens client relationships but also positions these firms as indispensable strategic partners in their clients’ success.

Explore the strategic benefits of adding AP management to your firm’s services. Contact us for a consultation to implement this valuable service and enhance value for your clients today.