Introduction

In the dynamic world of accounting, the emergence of automation technologies is reshaping the landscape, offering unprecedented efficiencies and capabilities. For professionals such as CPAs and bookkeepers, the shift towards these technologies is not merely keeping up with trends but a strategic imperative. This blog delves into the significant benefits that automation brings to accounting firms, underlined by the transformative effects of tools like MakersHub. We draw upon the real-life example of Patrice Diana, a seasoned QuickBooks ProAdvisor, to illustrate these benefits in practice.

1. Dramatic Time Savings

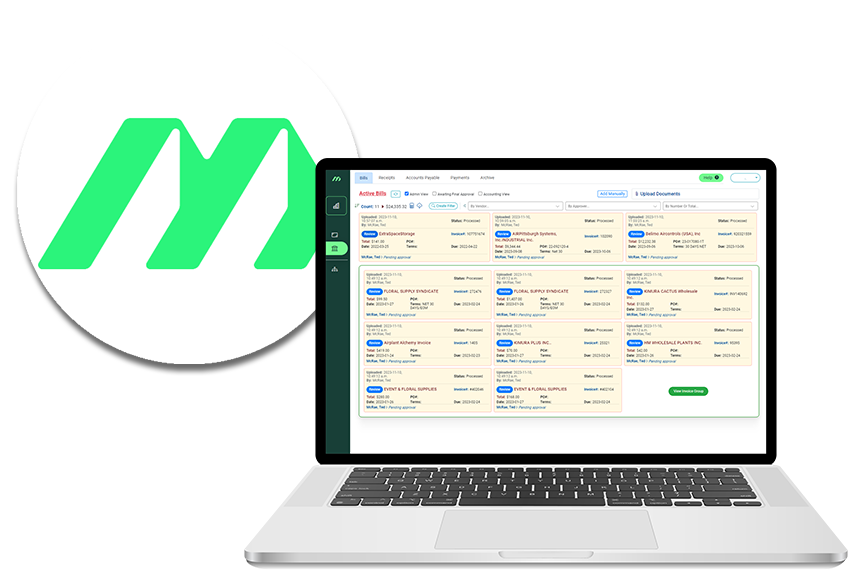

The integration of MakersHub into her practice marked a transformative shift. This innovative tool enabled Patrice to dramatically reduce the time required for accounts payable tasks from several hours to just minutes. For instance, she reported processing 91 bills in only 30 minutes, a task that previously took much longer. This remarkable increase in efficiency, reducing a weekly task to less than half an hour, translates to approximately 16 hours saved per month. This significant time saving has streamlined Patrice’s workflow, allowing her to devote more time to high-value tasks and strategic client engagement, thus enhancing her overall productivity and job satisfaction.

2. Enhanced Accuracy and Data Integrity

MakersHub addresses this need effectively by eliminating the risks associated with manual data entry. The tool ensures that all financial information is captured correctly and consistently, thus maintaining data integrity. This high level of detail in data processing is crucial for Patrice, directly impacting the quality of her bookkeeping services. Accurate coding of transactions is not just about maintaining orderly books; it’s about providing clients with reliable financial insights that guide their business strategies and decisions.

3. Streamlined Collaboration and Visibility

Effective collaboration and clear visibility in financial operations are essential in the complex field of accounting. Automation significantly enhances these aspects by streamlining workflows and increasing transparency. MakersHub, in particular, plays a pivotal role in this transformation. Its central inbox feature for bills and receipts provides much-needed transparency to the accounts payable process. This centralized system not only streamlines the management of financial documents but also ensures that all team members have access to the same updated information in real-time.

The benefits of this system were clearly evident in Patrice Diana’s practice. With MakersHub, she efficiently managed the entire accounts payable process, handling approvals, and adding essential context to financial records with unprecedented ease. Moreover, MakersHub’s granular access feature introduces a new dimension of collaborative efficiency. It allows specific access permissions for each team member, promoting collaborative work while safeguarding sensitive financial data. This feature was particularly advantageous for Patrice and her clients, enabling involvement of various stakeholders in the approval process without exposing confidential financial records.

4. Improved Scalability and Client Satisfaction

Scalability presents a multifaceted challenge in accounting, especially for firms experiencing rapid growth or managing a diverse client portfolio. As the number of clients increases, so does the complexity and volume of financial transactions. Traditional manual accounting processes can become a bottleneck, impeding the firm’s ability to scale efficiently. Automation, as exemplified by tools like MakersHub, is a critical enabler of scalability, allowing firms to manage increasing workloads without a proportional increase in resources.

The integration of MakersHub with QuickBooks, as demonstrated in Patrice Diana’s practice, showcases how automation facilitates scalability. The two-way sync feature ensures seamless data flow between QuickBooks and MakersHub, eliminating redundant data entry and potential errors associated with manual updates. This integration streamlines the accounting process, supporting the firm’s growth and enhancing client satisfaction. In today’s business environment, clients expect accuracy and promptness in financial reporting. MakersHub meets these expectations by providing real-time updates and accurate financial data.

For accounting professionals like Patrice, this means the ability to offer timely and reliable financial insights to her clients, a crucial factor in maintaining and nurturing client relationships. Additionally, the improved efficiency allows for more frequent and meaningful interactions with clients. This holistic approach to client service, supported by the robust capabilities of automation tools, not only satisfies existing clients but also attracts new ones, fostering a cycle of growth and client loyalty.

5. Superior User Experience and Operational Efficiency

The adoption of automation in accounting signifies a comprehensive upgrade in user experience and operational efficiency. Patrice Diana’s experience of moving from BILL to MakersHub vividly illustrates this shift. She compares it to transitioning from an old model car to a Lamborghini, highlighting the dramatic improvements in ease, speed, and overall efficiency. MakersHub, with its intuitive interface and streamlined processes, represents a significant advancement in managing accounting tasks.

For users accustomed to the cumbersome and time-consuming nature of traditional accounting systems, the switch to an automated platform like MakersHub is revelatory. It’s not just the speed at which tasks are completed, but also the user-friendly nature of the system that stands out. This ease of use is crucial, reducing the learning curve for new users and minimizing resistance to adopting new technologies. The result is a more efficient, agile, and responsive operational workflow, essential in today’s fast-paced business environment.

The transformation brought about by automation extends beyond individual tasks to encompass the entire operational workflow of an accounting firm. With tools like MakersHub, processes that were once fragmented and siloed are now seamlessly integrated, creating a more cohesive and efficient operational ecosystem. This integration ensures smooth data flow between different functions, reducing the risk of errors and redundancies. For accounting professionals like Patrice, this means that various aspects of their work – from data entry and bill processing to client communication and financial reporting – are all streamlined under a single, efficient system. The operational efficiency gained through this holistic approach not only enhances the firm’s productivity but also improves service delivery to clients. In essence, automation tools are not just facilitating individual tasks; they are reshaping the entire operational landscape of accounting, enabling firms to operate at a higher level of efficiency and effectiveness.